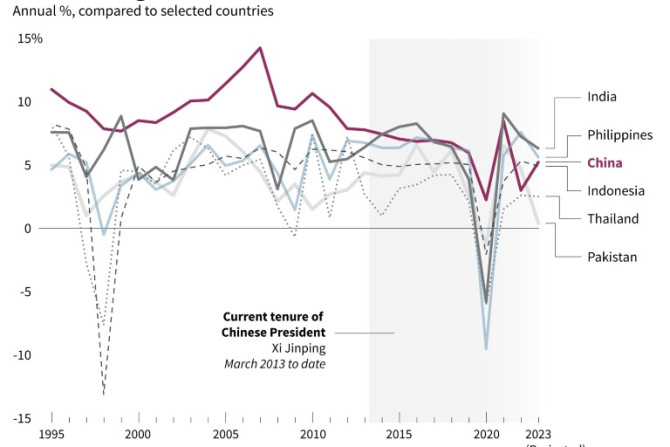

China's economy is expected to have slowed in the first three months of the year as it continues to be buffeted by a debilitating property sector crisis and flagging consumer activity.

AFP news

Apr 15, 2024

Asian markets fell Friday as traders struggled to build on Wall Street's positive lead, with hopes for a June interest rate cut fading, while earnings season gets underway in the United States amid optimism for companies' profit outlooks.

AFP news

Apr 12, 2024

Asian and European stock markets mostly fell Thursday before the European Central Bank's latest interest rate decision, after hotter-than-expected US inflation dented hopes for Federal Reserve rate reduction any time soon.

AFP news

Apr 11, 2024

Yellen arrived in the southern city of Guangzhou on Thursday for several days of talks with Chinese officials on her second visit to the world's second-largest economy in less than a year.

AFP news

Apr 05, 2024

The Abu Dhabi Department of Economic Development (ADDED) held the second Al Multaqa quarterly meetings in collaboration with the Abu Dhabi Investment Office (ADIO) on Thursday, where the growth of the private sector was discussed.

Sana Khan

Apr 05, 2024

Asian markets tumbled Wednesday as investors grow increasingly sceptical that the Federal Reserve will cut interest rates as much as hoped this year, while a massive earthquake in Taiwan added to the sense of gloom.

AFP news

Apr 03, 2024

Hong Kong stocks rallied Tuesday as traders returned from an extended weekend break to forecast-beating Chinese factory data that lifted hopes for the world's number-two economy, though other Asian markets were mixed.

AFP news

Apr 02, 2024

Asian markets were mixed while gold hit a record high Monday after data showed a slight uptick in US inflation that Federal Reserve boss Jerome Powell said was "in line with expectations".

AFP news

Apr 01, 2024

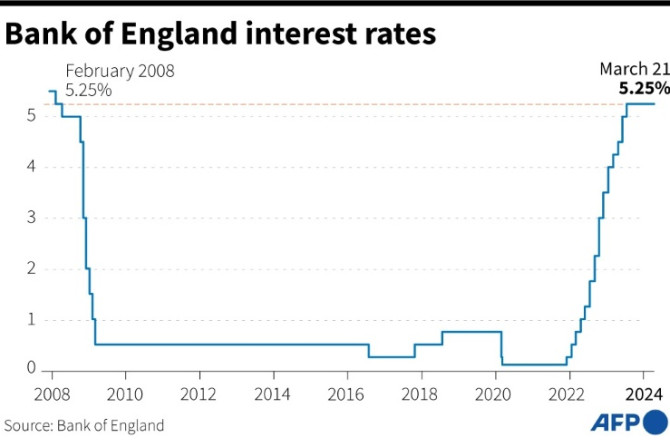

The Bank of England on Thursday held its key interest rate at a 16-year high, opting against a reduction as inflation remains elevated despite recent slowdowns.

AFP news

Mar 22, 2024

Asian markets mostly fell Friday after data pointing to a still-strong US economy raised fresh concerns about inflation and dampened optimism that the Federal Reserve will slash interest rates as much as it expected this year.

AFP news

Mar 22, 2024

The Swiss National Bank cut interest rates on Thursday -- the first to do so among the major central banks, saying the battle against inflation was working almost two years after launching its monetary tightening campaign.

AFP news

Mar 21, 2024

The Bank of England is widely expected to keep its main interest rate at a 16-year high Thursday, rejecting a cut as inflation remains well above target despite recent slowing.

AFP news

Mar 21, 2024

Asian markets mostly rose Wednesday as traders tracked another record day on Wall Street, with focus squarely on the Federal Reserve's policy meeting.

AFP news

Mar 20, 2024

The Bank of Japan announced a seismic change in direction on Tuesday, hiking interest rates for the first time in 17 years.

AFP news

Mar 19, 2024

The performance of China's economy in the first two months of 2024 was mixed, official figures showed Monday, with sluggish household consumption alongside increased industrial production reflecting an uneven recovery.

AFP news

Mar 18, 2024

The US economy is not expected to see stagflation, Treasury Secretary Janet Yellen said in an interview broadcast Wednesday, adding that most forecasters expect inflation to cool as housing costs move lower.

AFP news

Mar 14, 2024

China's exports sharply accelerated in the first two months of 2024, official figures showed Thursday, providing policymakers a bright spot as they battle to revive the world's second-largest economy.

AFP news

Mar 07, 2024

China's economic troubles are far from over and leaders admit the country will face an uphill struggle in hitting its goals for 2024, piling on the pressure for stimulus and reforms that experts say are needed to reverse the malaise.

AFP news

Mar 05, 2024

The European Central Bank is expected to freeze interest rates again this week, with officials wary of starting to cut before they see more evidence that recent falls in inflation will be sustained.

AFP news

Mar 04, 2024

China's leadership is confident the economy will improve, an official said Monday, ahead of a key political meeting in which Beijing is expected to unveil one of its most pessimistic growth targets in years.

AFP news

Mar 04, 2024

Minister of Economy Abdullah bin Touq Al Marri noted that more than 73% of the country's economy is now non-oil, marking a historic first for the country.

Sana Khan

Feb 28, 2024

Japanese inflation slowed less than expected to two percent in January, data showed Tuesday, hitting the central bank's target and firming expectations of an end to its outlier negative rates policy.

AFP news

Feb 27, 2024

Before Japan's asset bubble catastrophically burst in the early 1990s, stockbroker Ryuta Otsuka remembers waving a 10,000-yen note to hail a taxi after evenings sipping champagne at high-end Tokyo nightclubs.

AFP news

Feb 22, 2024

China's shares finished higher on Tuesday as its central bank announced a record cut to a benchmark lending rate in a bid to boost its struggling economy.

AFP news

Feb 20, 2024

China's new year holiday spending last week surged past pre-pandemic levels, official figures showed, a rare bright spot for an economy struggling with sluggish consumption and deflation.

AFP news

Feb 19, 2024

Britain is in recession, official data showed Thursday, dealing another blow to embattled Prime Minister Rishi Sunak, whose Conservative party is forecast to lose a general election expected this year.

AFP news

Feb 15, 2024

Once forecast to become the world's biggest economy, Japan slipped below Germany last year to fourth place, official data showed Thursday, although India is projected to leapfrog both later this decade.

AFP news

Feb 15, 2024

Chinese consumer prices fell in January at their quickest rate in more than 14 years, data showed Thursday, piling pressure on the government for more aggressive moves to revive the country's battered economy.

AFP news

Feb 08, 2024

The strategically-placed Indian Ocean nation of the Maldives, which has borrowed heavily from China and shifted allegiance from India, is at high risk of "debt distress," the IMF warned Wednesday.

AFP news

Feb 07, 2024

US Treasury Secretary Janet Yellen expressed concern Tuesday about the commercial real estate sector in the current environment of higher interest rates -- but added that the overall situation should be "manageable."

AFP news

Feb 07, 2024