On Wednesday, the government in its 2023/24 budget set a fiscal deficit target of 5.9% of gross domestic product for the coming financial year, down from the current year's target of 6.4% of GDP. India's fiscal year starts on April 1.

Reuters

Feb 03, 2023

The South Asian nation's economy is expected to grow 6.0% to 6.8% next fiscal year, the government said this week, slower than the 7.0% growth projected for the current year amid faltering global demand.

Reuters

Feb 03, 2023

Year-on-year inflation in January was recorded at 27.55 percent, its highest since May 1975.

AFP news

Feb 02, 2023

It desperately needs the International Monetary Fund to release an overdue tranche of $1.1 billion, leaving $1.4 billion remaining in a stalled bailout programme set to end in June.

Reuters

Feb 01, 2023

Cash is now king in Lebanon, where a three-year economic meltdown has led the country's once-lauded financial sector to atrophy.

Reuters

Feb 01, 2023

India's annual pre-budget economic survey is likely to peg GDP growth at 6-6.8% for 2023-24, according to a source.

Reuters

Jan 31, 2023

Oil prices climbed in early Asia trade on Monday, supported by tensions in the Middle East following a drone attack in Iran and as Beijing pledged over the weekend to promote a consumption recovery which would support fuel demand.

Reuters

Jan 30, 2023

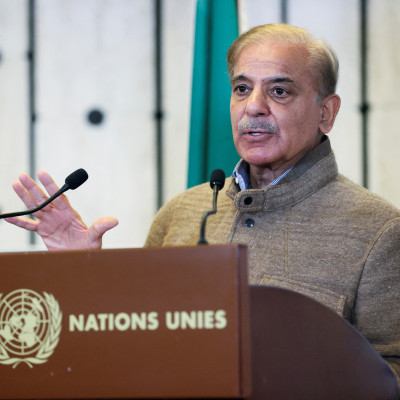

On Thursday, the Pakistani rupee fell 9.6% against the dollar in the inter-bank market, the biggest one-day drop in over two decades, a day after foreign exchange companies removed a cap on the exchange rate.

Reuters

Jan 27, 2023

Presenting a quarterly economic report, the bank's Governor Sahap Kavcioglu stood by previous year-end annual inflation forecasts for 2023 and 2024 of 22.3% and 8.8% respectively.

Reuters

Jan 26, 2023

The 2023 growth forecast is well behind an International Monetary Fund forecast of 2.7% that was issued in October and is due to be updated next week.

Reuters

Jan 26, 2023

Officials and economists said the large size of recent deficits and a need to gain investor confidence was forcing fiscal caution on the government,

Reuters

Jan 25, 2023

Crude oil prices rebounded on Wednesday as demand recovery hopes in top importer China following its exit from COVID-19 pandemic curbs provided support after prices dropped in the previous session on concerns about global economic growth.

Reuters

Jan 25, 2023

Economic growth in the United Arab Emirates (UAE) was expected at 3.3% this year, down from 6.4% last year.

Reuters

Jan 24, 2023

The government says it is doing what it can to tamp down prices and expand social spending, often blaming current pressures on external factors linked to the war in Ukraine.

Reuters

Jan 20, 2023

Oil prices fell on Thursday after industry data showed a large unexpected increase in U.S. crude stocks for a second week, heightening concerns of a drop in fuel demand.

Reuters

Jan 19, 2023

About two billion tonnes of carbon dioxide are being removed from the atmosphere every year, according to a report published on Thursday, but nearly all of it is accomplished through forests, despite growing investments in new technologies.

Reuters

Jan 19, 2023

Oil prices rose on Wednesday, extending the previous session's gains, driven by optimism that a relaxation of China's strict COVID-19 curbs will lead to a recovery in fuel demand in the world's top oil importer.

Reuters

Jan 18, 2023

The Egyptian pound has lost half its value against the dollar since March, following a devaluation demanded as part of a $3 billion International Monetary Fund loan agreement.

AFP news

Jan 17, 2023

Gold prices are expected to rise towards record highs above $2,000 an ounce this year, albeit with a little turbulence, as the United States slows the pace of rate hikes and eventually stops increasing them, according to industry analysts.

Reuters

Jan 17, 2023

"The fundamental reason" for this depreciation is "external constraints", said Muzhar Saleh, a financial adviser to Prime Minister Mohammed Shia al-Sudani.

AFP news

Jan 16, 2023

Iranian oil exports hit new highs in the last two months of 2022 and are making a strong start to 2023 despite U.S.

Reuters

Jan 16, 2023

The clear-out had initially been expected to last weeks, but police said on Sunday only two activists remained in the village, holed up in an underground tunnel.

AFP news

Jan 16, 2023

A shortage of crucial dollars has left banks refusing to issue new letters of credit for importers, hitting an economy already squeezed by soaring inflation and lacklustre growth.

AFP news

Jan 16, 2023

The world will need natural gas for a long time and more investment is required to ensure supply security and affordable prices during the global energy transition, the energy ministers of Qatar and the United Arab Emirates said on Saturday.

Reuters

Jan 16, 2023

Oil prices slipped in early trade on Friday but were on track for gains of more than 6% for the week on solid signs of demand growth in top crude oil importer China and expectations of less aggressive interest rate hikes in the United States.

Reuters

Jan 13, 2023

Oil prices were little changed on Tuesday, giving up some of the gains from the previous session, as traders awaited clarity on the Federal Reserve's plans for rate hikes to gauge the impact on the economy and fuel demand.

Reuters

Jan 10, 2023

Oil prices edged up on Monday, a day after travellers streamed into China following a reopening of borders that lifted the fuel demand outlook and partly offset concerns of global recession.

Reuters

Jan 09, 2023

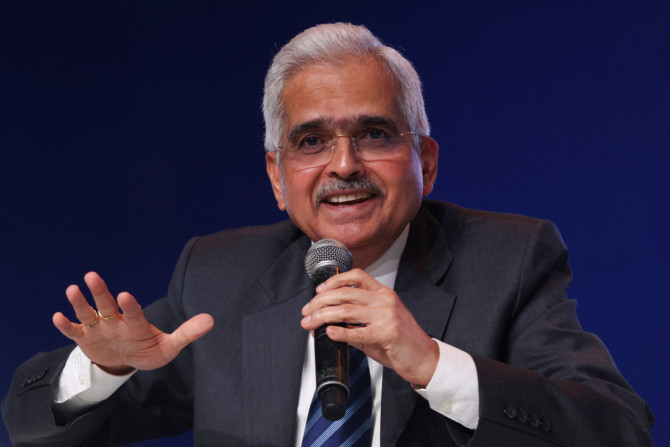

Speaking at an event organised by the International Monetary Fund (IMF), the Indian central bank chief said policy challenges in the region have sharpened due to the Covid-19 pandemic and the war in Ukraine.

Reuters

Jan 06, 2023

Oil prices rebounded on Thursday after opening the year down more than 9%, the worst yearly start in over three decades, as investors took advantage of the decline to buy futures on expectations long-term fuel demand will remain steady.

Reuters

Jan 05, 2023

The cash-strapped North African country is battling 10 percent inflation alongside slow growth, high unemployment and shortages of basic goods, exacerbated by the Covid pandemic and the war in Ukraine.

AFP news

Jan 04, 2023