$XRP Retreats Amid News Circle Rebuffed Ripple's Takeover Offer

KEY POINTS

- Ripple has reportedly not yet considered whether it should make another offer

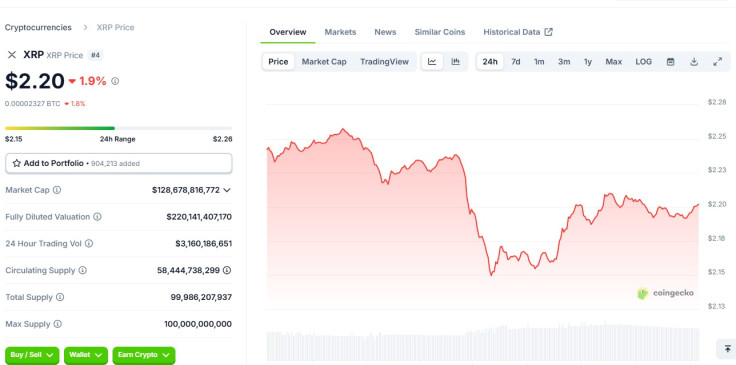

- $XRP is down nearly 2% in the day following the takeover rejection

- Ripple has been busy acquiring companies over the last two years

- Just last month, Ripple agreed to acquire prime broker Hidden Road for $1.25 billion

XRP prices retreated overnight after a new report revealed that Circle Internet Group Inc., the issuer of the popular USDC stablecoin, rejected a takeover bid from Ripple valued between $4 billion and $5 billion.

Ripple, which is the largest corporate holder of the XRP crypto coin and oversees the development of the XRP Ledger blockchain, has yet to decide on whether it should make another offer to acquire the prominent stablecoin issuer, Bloomberg reported Wednesday, citing people familiar with the matter.

Circle, on the other hand, has been working on an initial public offering (IPO) in the United States. Ripple's offer was supposedly made less than a month after Circle applied for an IPO.

"We do not comment on market rumors," a Circle spokesperson said in a statement regarding the matter.

Ripple already has its own stablecoin, the RLUSD, so it is unclear why it is attempting to acquire a stablecoin issuer.

$XRP Dips Amid News

As soon as news of the supposed takeover rejection spread, XRP prices started to dwindle.

Data from CoinGecko showed that the popular cryptocurrency is down nearly 2% in the day. The digital asset has been struggling to reach $3 again in recent weeks amid a broader downturn in the crypto market.

Still, the XRP community remains steadfast and have been actively using the coin, as the latest data showed that trading volumes in the last 24 hours passed $3 billion.

Ripple's Takeover Frenzy

The reported bid to acquire Circle comes as Ripple has been cleaning up on its legal woes in the U.S., where President Donald Trump has promised he will make the country the global crypto hub.

In recent years, Ripple has made some acquisitions, and the Circle offer may be part of its greater plans to expand its fintech and blockchain business.

Early in 2023, Ripple acquired Swiss digital asset custodian Metaco for $250 million to expand its custodial, issuance, and settlements on tokenized assets.

Later that year, the blockchain and fintech firm acquired Nevada-based chartered trust company Fortress Trust but details about the acquisition's financial terms were not revealed. Fortress Trust has a specialty in crypto and Web3.

Early last year, Ripple said it has closed its acquisition deal of enterprise-grade digital assets platform Standard Custody & Trust Company, a regulated entity.

Finally, just last month, Ripple agreed to acquire prime broker Hidden Road for $1.25 billion in one of the known largest deals in the crypto space.

It remains to be seen what Ripple plans if it completes an acquisition of a stablecoin issuer and whether Circle will consider a subsequent, much higher takeover offer.

Originally published on IBTimes

© Copyright IBTimes 2025. All rights reserved.